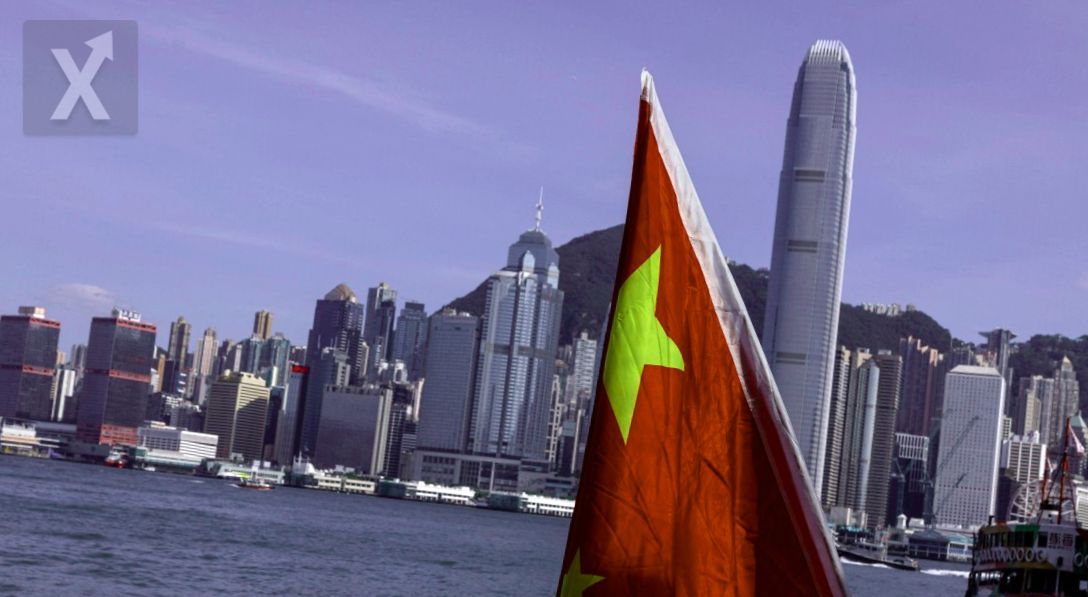

China to Launch Debt Wave to Boost Its Economy

On Saturday, China announced it would embark on a significant public debt investment through the issuance of special bonds, aiming to revive its economy, which has been facing a slowdown, while giving a boost to the real estate and banking sectors. This decision adds to a series of actions announced in recent weeks, including a reduction in interest rates, and seeks to strengthen banks, bolster the real estate market, and encourage consumer spending.

Regarding the real estate sector, local governments will be allowed to increase their borrowing to purchase developable land, a move expected to revitalize the stagnant real estate market. According to Finance Minister Lan Fo'an, while he did not provide many details on the special bonds, he assured that China still has room "to issue debt and increase the deficit" in order to finance new measures. In 2023, the country's growth was one of the lowest in three decades, at 5.2%, a figure that some economists view as questionable. Lan stated that the issuance of additional treasury bonds is being expedited, and ultra-long-term bonds are also being launched. Over the next three months, it is expected that 2.3 trillion yuan (approximately $325 billion) will be made available through special bonds.

Moreover, the Chinese government plans to "issue special government bonds" to enhance the resilience to risk and the lending capacity of state-owned banks, aiming to better support the development of the real economy. Deputy Finance Minister Liao Min mentioned that special bonds will be issued so local governments can acquire land for urban development, which is expected to boost the real estate market. This measure "will help alleviate the pressure faced by local governments and real estate companies in terms of debt and liquidity," he remarked. The purchase of existing commercial properties for conversion into affordable housing will also be encouraged. However, the lack of precise information regarding the magnitude of these additional fiscal incentives has drawn criticism among analysts. "The message is clear: the central government has the capacity to issue more bonds and increase the fiscal deficit to help local governments meet their debt obligations," said Zhiwei Zhang, president and chief economist of Pinpoint Asset Management. However, Beijing "is likely still working on the details," added Heron Lim from Moody's Analytics. Economic uncertainty has also impacted consumption. Julian Evans-Pritchard, director of China economics at Capital Economics, commented on the notable absence of mention of major aid for consumers in recent announcements. The lack of a projection for next year’s budget deficit makes it difficult to assess the effectiveness and duration of fiscal stimuli. While the Chinese government aims for a 5% growth this year, which is a desirable figure, it is far from the double-digit expansions that characterized its economy in past years. Although stimulus measures have been introduced to address economic uncertainty, such as rate cuts and flexibility in home purchases, many economists believe more needs to be done. This Saturday, major banks in China announced a reduction in interest rates for existing mortgages starting October 25, according to reports from state media. With some exceptions for second mortgages, "the interest rates on other eligible mortgages will be adjusted to be at least 30 basis points below the central bank's benchmark rate," reported state broadcaster CCTV. Banks confirmed that these adjustments "will be implemented uniformly... and customers will not need to apply for them," CCTV added. This week, China’s central bank also boosted its market support by unleashing tens of billions of dollars in liquidity for companies to acquire stocks. Beijing indicated that the 500 billion yuan ($70 billion) "swap" mechanism will stimulate "the healthy and stable development of the capital markets."

China’s strategy to resort to borrowing to stimulate its economy reflects a pragmatic approach in times of economic uncertainty. However, it is crucial that these measures are implemented with a long-term plan that not only drives immediate growth but also ensures financial sustainability. The key will be to balance debt growth with an increase in productivity and consumption to avoid falling into detrimental debt cycles.