The Pulse of Consumption in Mexico: Wages, Support, and Remittances

Amid rising inflation and high interest rates, consumption in Mexico has remained a fundamental support for the economy, driven by increases in the minimum wage, support from social programs, and remittances. Despite the fact that inflation has stayed outside the thresholds established by the Bank of Mexico (Banxico) for 42 months, private consumption is at its highest point so far in 2024, accounting for nearly 60% of the national GDP.

Experts have pointed out that the policies implemented during this administration, which included raising the minimum wage and social transfers, were key in boosting household consumption and thus fostering economic growth. “We have seen minimum wage increases averaging 20% during López Obrador’s government, and at the same time, there has been about a 10% rise in private sector wages over the last few quarters,” says Gabriel Lozano, chief economist at JP Morgan in Mexico. “The economic policy of recent years has focused on strengthening private consumption,” he adds. Since December 2018, the government has raised the minimum wage from 88.36 to 102.68 pesos, and to 176.72 pesos in the border region. These increases have been consistent, except for 2021, when, due to COVID-19, there was a 16% increase. During the pandemic, consumption shifted toward durable goods, as many Mexicans needed to adapt to working from home, primarily purchasing computers and furniture. There was also an increase in savings capacity, according to data from the Association of Banks of Mexico. Another factor favorable to consumption has been the unemployment rate, which has been at historically low levels, below 3%. However, JP Morgan warns that this strength in formal employment shows signs of weakness; in May and June of this year, the Mexican Social Security Institute (IMSS) reported negative job creation figures. “Despite facing high inflation levels, real wage increases have been beneficial for consumers,” concludes Lozano. During his term, President Andrés Manuel López Obrador also promoted financial support for older adults, starting with 1,160 pesos every two months, which eventually rose to 6,000 pesos towards the end of his term. Support for agriculture was also implemented through the ‘Sembrando Vida’ program, as well as scholarships for students and resources for people with disabilities. Lozano insists that these programs, despite the risks they pose to fiscal stability, have benefited consumption.

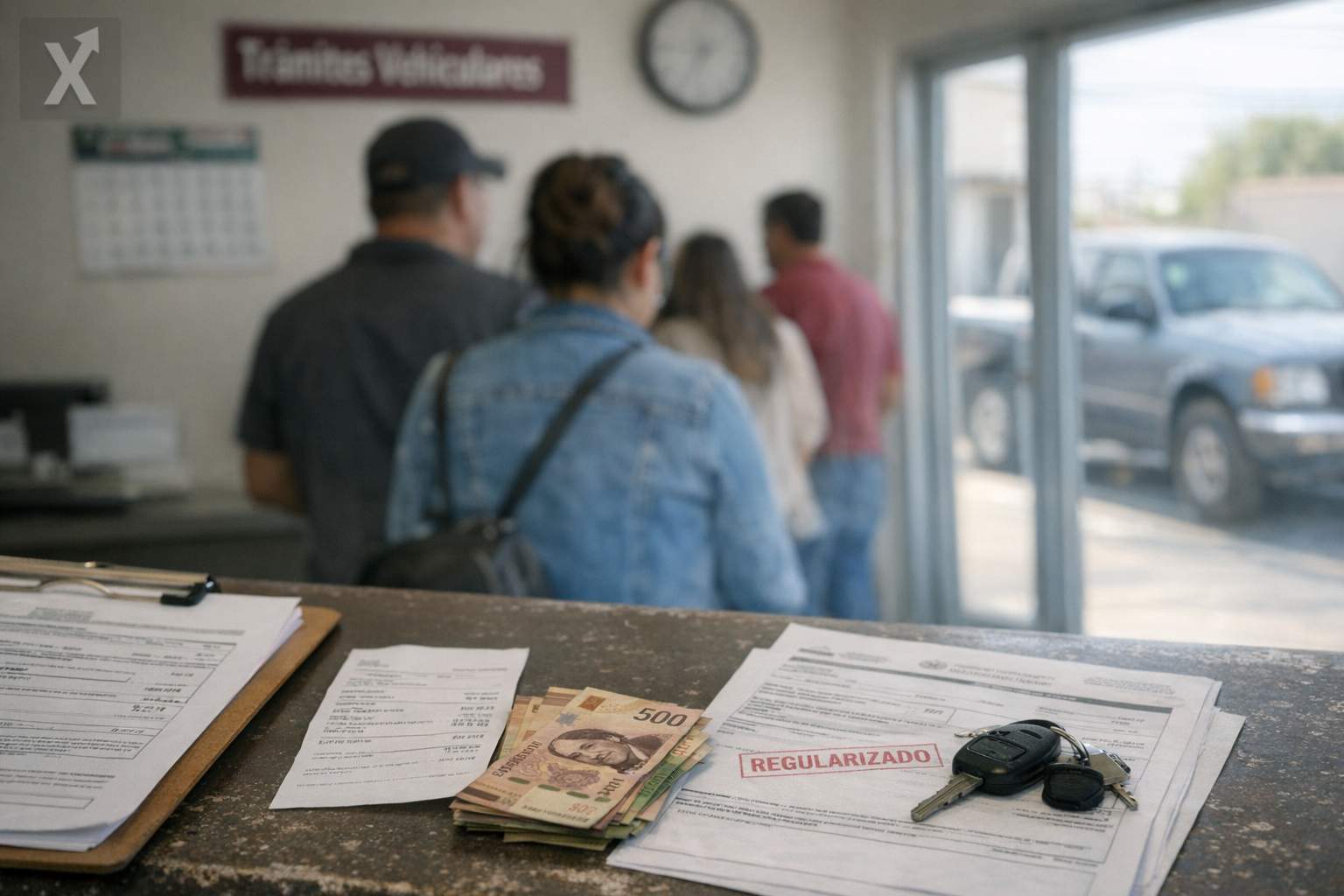

Remittances on the Scene Government actions have not been the only influence; since 2020, remittances to Mexico have grown at double-digit rates. “Before the pandemic, people receiving remittances used them to buy land, expand their homes, or acquire new appliances. Nowadays, the trend has shifted, and more is going toward daily consumption; remittances come in and are spent immediately,” notes Gabriel Casillas, chief economist at Barclays. Nevertheless, data on remittances indicate a slowdown, as since October of last year, growth has decreased to single digits, while before the pandemic, the increases were considerable. In addition, labor dynamics have changed, enabling remote work, which has also facilitated the arrival of foreign tourists who boosted consumption. “During the pandemic, Mexico did not close its doors to international tourists, which led to a medium-term influx of several foreigners, fueling faster consumption in various economic sectors. This pointed to an increase in consumption from discretionary spending,” adds the JP Morgan economist. López Obrador’s arrival has helped strengthen consumer confidence, a key indicator measured by Inegi. “Consumer confidence in Mexico is closely linked to the president's approval,” emphasizes Casillas. Credit Situation Consumer credit has also shown strength. Lozano explains that bank credit growth has occurred at a rate three times that of economic activity. This type of credit has performed better than credit directed to businesses or the government. Currently, it represents over 50% of the credit issued by banks, and since the second quarter of 2022, it has experienced double-digit growth, according to Banxico data. However, this dynamism seems to be coming to an end, as it is expected that the deceleration in the economy will also reduce the pace of consumption. “We are entering a more mature phase of the economic cycle; after several years of accelerated spending and high investments, both consumers and investors are beginning to slow down their activity,” warns Lozano. The Bank of Mexico estimates that the country's growth will be 1.5% in 2024, a figure that falls well below last year’s 3.2%.Changes in the Mexican economy highlight a delicate balance. While consumption has remained strong due to wage increases and remittances, it is crucial for both consumers and the government to prepare for a more moderate economic cycle. Financial flexibility and prudent credit management will be essential to face the challenges ahead. Furthermore, support policies should be continuously evaluated to ensure they meet their goal of helping Mexican families without compromising long-term fiscal stability.