Impact on the Mexican Economy if Trump is Elected and Imposes Tariffs: Moody's

Next year looks tough for the Mexican economy if Donald Trump wins the presidential election in November. His plan to impose a 10% tariff on all imports from the U.S. would bring several complications. According to the credit rating agency Moody's, Mexico's economy could enter into recession by 2025, with a decline in production due to a decrease in trade.

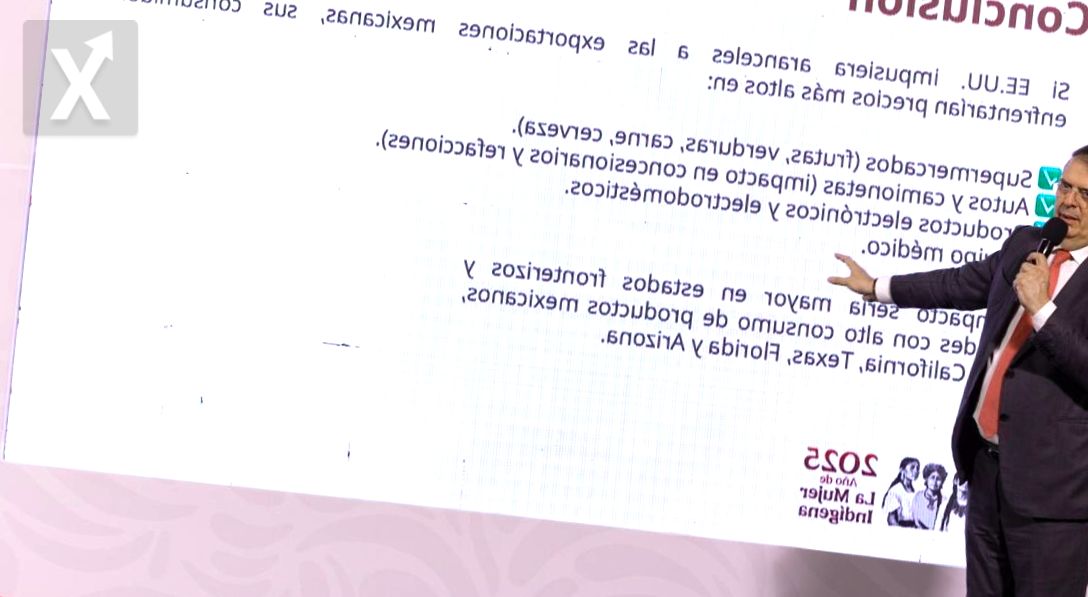

In addition to this, inflation is expected to rise both from the impact of U.S. tariffs and from the depreciation of the peso that would result from an increase in the trade deficit and greater risk aversion. This scenario outlines that the general tariff for Mexico would be 10% on all its exports, starting from the first quarter of 2025. However, the agency mentions that beyond the solutions and resources offered by the USMCA, Mexico could also respond by imposing a 10% tariff on all imports from the United States. While there would be a negative impact for Mexico, the effects of this tariff war would be significantly felt in both countries and on the global economy, affecting growth, inflation, and financial stability. According to Moody's, "the economic effects in this context, which would include a U.S. tariff and a reciprocal response from Mexico, would result in an even more depressed context for bilateral trade, pushing us towards higher inflation due to increased import costs on both sides." An automatic reaction in the exchange rate is also anticipated in response to the risk of a more intense and prolonged tariff war." An additional defensive measure noted by the agency for Mexico is the possibility of allowing the peso to depreciate competitively to mitigate the impact of the tariffs and prevent the trade war from escalating beyond manageable levels, where everyone would end up losing. This strategy could be gradually implemented as an internal measure to absorb external shocks, utilizing the duality offered by interest rates and the exchange rate. "Despite being a less arbitrary defense mechanism than tariffs, there is a risk that the country will be perceived as a currency manipulator," it warns.

The economic situation in Mexico can be quite volatile in the face of political changes in the United States. It is crucial for the country to diversify its markets and strengthen its domestic economy to mitigate the adverse effects of these trade tensions. A proactive approach toward investment in innovation and strategic sectors could help minimize the impact of future tariff wars.